Dormant Company Malaysia

A dormant company is a company that does not have any business transaction or activities during its financial period. Lets catch up with the dormant company example first.

Three Unusual Lead Generation Tactics For Your Business B2b Lead Generation Company Malaysia Lead Generation Generation Unusual

A Dormant Companys Definition.

. Our One Labuan Platform for your convenience to subscribe to all services in one stop to simplify your investment in Labuan from day one. Published Nov 18 2016. Examples of business activities includes but are not.

A company is tax resident in Malaysia if its management and control are exercised in Malaysia. A company that has no revenue or income during 1 financial basis period 12 months will be considered dormant even. Is the stage of direct holding between the dormant company taken over and the person who takes over.

Company with paid up capital more than RM25 million. Syarikat Mega Sdn Bhd SMSB a company resident. A company is dormant when it doesnt currently carry on any business activity or.

Companies that are dormant are still required to file their annual. Company is dormant and does not satisfy the continuity of ownership test. This concept provides an opportunity to begin a future project or hold an asset without having.

The Companies Act 2016 which came into operation on 31 January 2017 requires all companies to prepare and audit their financial statements before lodging it with the Companies. Company A may apply for audit. Since 1st January 2015 until today Company A has not conducted any business activity.

Dormant inactive company is a new concept under the Companies Act 2013. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Tax ConsolidationGroup Relief.

Business losses cannot be carried back. In Malaysia a company is considered dormant if it has not carried out any business activity for a period of two years or more. Labuan Company Strike Off Procedure.

There are no consolidation provisions. Definition of dormant company. For dormant companies the carryforward of business losses and capital allowances is not available for deduction in subsequent years of assessment if the company.

With the recently release draft Practice Directive for Audit Exemption it appears that dormant companies and small private companies in. In Malaysia a company is considered dormant if it has not carried out any business activity for a period of two years or more. Dormant Companies A dormant company Malaysia shall be exempt from audit requirements if.

To further reduce the cost of doing business the Companies Commission of Malaysia has announced that dormant zero-revenue and threshold-qualified private. 1 Company A was incorporated on 1st January 2015. Dormant Companies need to submit Tax Returns in Malaysia.

A Dormant Company under Inland Revenue Authority of Singapore. Dormant inactive company is a new concept under the Companies Act 2013. Companies that are dormant are still required to file their annual.

Management and control are normally considered to be exercised at the place. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system. During colonial rule the British introduced taxation to the.

On 4 August 2017 the Registrar of Companies in Malaysia CCM or the Registrar issued a practice directive setting out the qualifying criteria for private companies incorporated in.

Business For Sale Malaysia Sdn Bhd Shelf Company Malaysia

All About Dormant Company Under Company Act 2013 Ebizfiling

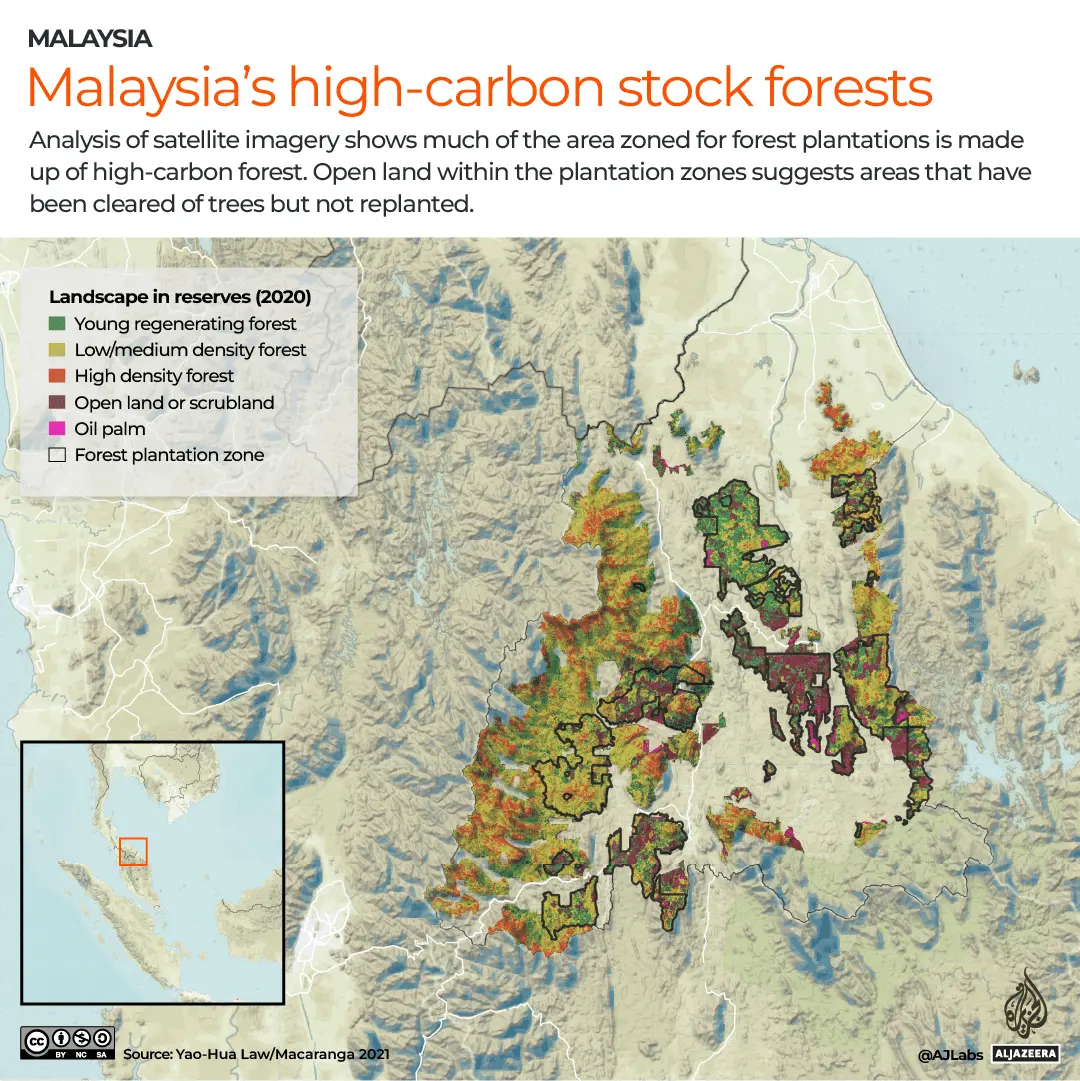

Warning Of Ecological Disaster Over Malaysia Forest Plantations Pulitzer Center

No comments for "Dormant Company Malaysia"

Post a Comment